What is a Sinking Fund?

What is a sinking fund?In the world of leasehold flats, “What is a sinking fund?” … or … “What is a reserve fund?” … are regular questions, for me and for property managers more generally. The answer, in short, is … “Money which is put away in the cheap years to pay for major works in the expensive years”. The amount of money put away in each year, should have a methodology behind it – as explained below. But, this can only be done if the terms of the lease permit such a fund – so if in doubt, ask.

The use of a sinking fund – or a series of sinking funds – is generally a sign of good property management. It requires thought and planning – both of which are useful for the successful running of a building.

The Starting Point

The starting point is an inspection of the building, and in particular, those parts of the building which deteriorate slowly (almost unnoticed) and which are costly to renew (often due to difficult access, or skilled labour, or costly materials, or all of those). These might be internal things like lifts, fire alarm systems, swimming pools – or external things like roof coverings, window frames, trees and drainage systems. Each topic or project should be added to a list for further consideration.

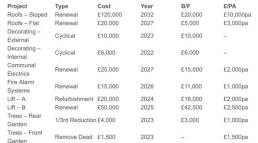

Once the list is complete the next stage is to work out the numbers. This generally involves specialist contractors inspecting and providing budget costings for either ‘renewal’ or ‘major refurbishment’. And those specialists will also need to advise on when those works will need completing.

Number Crunching

Having obtained the data, the sinking fund number crunching can begin. This looks at how much is needed for each project … how much has been set aside to date … consequently how much is still to be collected … and thus, how much needs to be collected each year to reach the target. That exercise produces something like the diagram attached.

Sinking Fund Challenges

One of the challenges to this sinking fund process, is the fact that costs rise. What is currently predicted to be £120,000 in 2032 … will change considerably, no doubt, between now and then. Each project budget is therefore an ever-moving target.

It is therefore essential that the figures are reviewed regularly – and the easiest way to remember to do that, is to include it within the annual service charge budget process.

Now, there is no need to annoy the specialists every year without fail but checking the estimated costs every two or three years is worthwhile. And in the final three or so years, take a closer look at the scope and detailed costs, including project management fees, materials availability, et cetera.

Sinking Fund Disadvantages

There are two main disadvantages to the above process, I find … the first being … time. It takes time to go through the process properly each year – and invariably it’s a busy time of year with too many things to do. Sticking to the plan is difficult but will save a lot of grief in later years, as the big numbers become a looming reality.

The second disadvantage is that getting the yearly sinking fund contributions right, has the bi-product of making the ‘cheap years’ more expensive. The total service charge is more expensive than it otherwise would be – and that is commonly not welcomed by the “tomorrow is not my problem” crowd. Property managers and Resident Directors have to be firm in order to herd the nay-sayers in the right direction. Jam tomorrow is never as appealing as smaller bills today.

Never Rob Peter

Within the description ‘sinking fund’ there are two distinct types – which the accountants will want to clarify for certain. There are “designated” funds and “general” funds.

Designated sinking funds are where money is set aside for a specific purpose; e.g. roof renewal. General sinking funds, on the other hand, are non-specific and can be used for whatever shortfall needs filling. Designated sinking funds should only be spent upon the project they’re created for – nothing else.

And the biggest mistake I’ve seen over my 40+ years of property managing – is where Resident Directors (or inexperienced property managers) “rob Peter to pay Paul”. They suddenly find a major cost arrives and they take money from the decorating fund to pay for the leaking roof … or whatever. Whilst I can see the cash flow reasons for that move today – it only produces a bigger problem tomorrow. It is to be avoided, almost at all costs.

Conclusion

Sinking funds … or reserve funds, if you prefer … are a good idea. They take time to administer and get right … but that time is well spent and leaseholders are rewarded in the ‘expensive years’ because they have a pot of gold to help them maintain a steady year-on-year service charge level.

Property managers are rewarded because planned maintenance and planned sinking funds, produce a well-managed and financially consistent block. That tends to produce happy clients – who keep renewing the management agreement, every year.

What Next?

So, the ‘call to action’ at the end of this article is … check your service charge budget and see if your building has sinking funds or reserve funds. If it does – are they regularly reviewed and sensibly calculated. Discuss the methodology with your Resident Directors or property manager … or both.

If your building doesn’t have money set aside – perhaps you need assistance to get started. The starting place is “RTBL” as usual … Read The Bl**dy Lease to see if reserves are permitted.